All contributions are 100% tax-deductible to the fullest extent allowed by law.

Gifts Of Cash

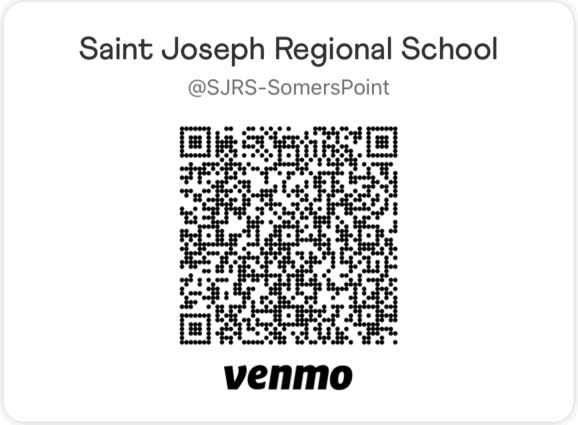

Saint Joseph Regional School accepts gifts of cash either by check or credit card (Visa, MasterCard, Discover and American Express). Please call Christine Ulrich, Advancement Director, at (609) 927-2228 ext. 109 to make your gift of cash. In addition, you can give online or you can mail your gift to:

Saint Joseph Regional School

Attention: Advancement Office

11 Harbor Lane

Somers Point, NJ 08244

Gifts-In-Kind

Gifts in kind are gifts other than cash or securities. They are very important to Saint Joseph Regional School, as they provide incentive for our community to participate in silent and live auctions at events. Gifts in kind can also be used, in some cases, to defray the budget cost to the school of having to purchase an item.

Procedure for gift in kind receipts

Saint Joseph Regional School uses a special gift in kind receipt. This receipt is to be issued by the person actually taking the gift from the donor. The person taking the gift completes the form and a copy is retained by the Advancement Office so that the gift may be recorded and recognized by the School. The donor will then use this receipt to verify that a tax deductible contribution has been made to the Saint Joseph Regional School.

Assigning dollar value

Following IRS guidelines, Saint Joseph Regional School does not assign a dollar value on receipts for any gift in kind item received. It is the donor’s responsibility to assign this value. Donors are encouraged to staple any store receipts to their copy of the gift in kind receipt that directly corresponds to the item(s) described on the gift in kind receipt. This makes it easier for donors to remember the value of the gift should they wish to use this information later for tax purposes.

Matching Gifts

Are you interested in growing your gifts to Saint Joseph Regional School – doubling, perhaps even tripling them? Corporate matching gift programs offer an easy way to do this. Many companies will match their employees’ gifts. This annual program involves no cost for employees, and Saint Joseph Regional School can benefit!

Arranging for a matching gift

- Obtain a copy of your matching gift form from your company’s Human Resource Department and send it with your gift to the Saint Joseph Regional School Advancement Office. Some companies are using electronic forms. They can be emailed to Christine Ulrich at culrich@sjrs.org

- Saint Joseph Regional School will verify your gift and return the matching gift form directly to your company’s designated matching partner.

- Saint Joseph Regional School will then receive a check from your employer matching your gift.

Already given? Most matching companies will honor gifts given within the current calendar year. Simply send or bring your matching gift form to the Advancement Office, and we’ll take care of it from there.

For more information, please contact Christine Ulrich, Advancement Director at (609) 927-2228 ext 109. Certain restrictions apply for matching gifts; please consult your company’s Human Resource Department for further information.

Memorial Gifts

Unless otherwise designated, memorial donations will go to the Annual Fund. Please include the name of the person in whose memory the donation is being made and the name and address of a family member. All donations will be acknowledged in the Annual Report and a list of donors will be provided to the family upon request. Please contact Christine Ulrich, Advancement Director, at (609) 927-2228 ext 109 for more information.

Checks should be made payable to Saint Joseph Regional School and mailed to:

Saint Joseph Regional School

Attention: Advancement Office

11 Harbor Lane

Somers Point, NJ 08244

Planned Giving & Endowments

Planned Giving is a set of ways a donor can leave money/assets to a nonprofit at his/her death; or a way to invest money so that the donor receives benefits during his/her life and then bequeaths the remaining funds to the nonprofit.

Bequests are the transfers of wealth that occur upon a donor’s death and that include transfers by means of a will or a trust. Bequests can take several forms such as:

- Specific bequest – a certain amount of cash, securities, or property.

- General bequest – property that is similar to all other items distributed, usually cash.

- Percentage bequest – a stated percentage of the donor’s estate.

- Residual bequest – all or a portion of what remains of the estate after specific and general bequests are distributed.

Endowment is a fund that is made up of gifts and bequests that are subject to a requirement that the principal be maintained intact and invested to create a source of income for an organization. Donors may set up an endowment to fund a specific interest; and a nonprofit’s governing body may set up an endowment. In any case, an endowment requires that the principal remain intact in perpetuity, or for a defined period of time, or until sufficient assets have been accumulated to achieve a designated purpose.

GIFT OF SECURITIES

Gifts of appreciated securities may have significant tax benefits. All gifts of securities are tax

deductible to the fullest extent of the law. The Diocese of Camden maintains a custodial

relationship with PNC Bank, NA. for the purposes of transferring securities.

For stock gifts, please download the Stock Gift form by clicking on the link below and send the completed form to your broker. Please also notify Christine Ulrich at culrich@sjrs.org so we may monitor the process.